Investiit.com Tips can be daunting, especially for beginners. However, with the right strategies, success is achievable. First, understanding the basics is crucial for informed decisions. Additionally, setting clear investment goals helps shape your approach. Furthermore, risk management plays a significant role in protecting your assets. Many investors overlook research, but it’s essential for identifying opportunities. In this article, we will explore top strategies from Investiit.com. Ultimately, effective investing requires continuous learning and adaptation. Let’s enhance your investment journey together!

Understanding Investment Basics

Investiit.com Tips start with understanding key concepts. Initially, it’s important to know what an investment is. Generally, an investment is allocating resources for potential returns. Moreover, various asset types exist, including stocks, bonds, and real estate. Each type has its own risk and reward profile. For instance, stocks might have bigger profits, but they also have more volatility.

Furthermore, diversifying your portfolio is vital for reducing risk. This entails distributing your money among many asset types. Additionally, time is a critical factor in investing. Typically, the longer you invest, the greater your potential returns. Consequently, compounding interest can significantly boost your wealth over time. Ultimately, grasping these basics sets a solid foundation for successful investing.

Research and Analysis Techniques

Research plays a vital role in making informed investment decisions. First, identify credible sources of information, such as reliable financial news outlets. These platforms often provide valuable insights and up-to-date market analysis. Next, focus on data analysis to understand market trends effectively. Charts and graphs visually represent important information, helping investors identify patterns and make educated predictions.

Furthermore, fundamental analysis should be considered, which evaluates a company’s financial health by reviewing earnings, expenses, and growth potential. Additionally, technical analysis focuses on historical price movements, revealing trends. Ultimately, combining these research techniques enhances your investment strategy and leads to more successful outcomes.

Diversification: A Key to Stability

Diversification is essential for reducing investment risks. First, it involves spreading investments across various assets. This strategy lowers the potential impact of any single investment’s poor performance. Additionally, different asset classes often react differently to market changes. Thus, when one asset declines, others may rise.

Moreover, diversifying can enhance returns over time. For instance, mixing stocks, bonds, and real estate creates a balanced portfolio. As a result, investors can achieve better overall performance. Furthermore, regular rebalancing of your portfolio is important. This procedure guarantees that your investments and your objectives line up. Ultimately, diversification contributes to a more stable financial future.

Long-term vs. Short-term Investment Strategies

Investiit.com Tips often choose between long-term and short-term strategies. First, long-term investments focus on growth over several years. This approach typically involves stocks, mutual funds, and real estate. Over time, compounding can significantly increase returns.

Conversely, short-term investments aim for quick profits. This strategy often includes day trading and options. However, it involves higher risks and market volatility. Investors must be vigilant and informed.

Moreover, each strategy suits different financial goals. Long-term strategies benefit those seeking stability. Meanwhile, short-term strategies may appeal to risk-tolerant investors. Ultimately, understanding both approaches helps investors make informed decisions.

Leveraging Technology in Investing

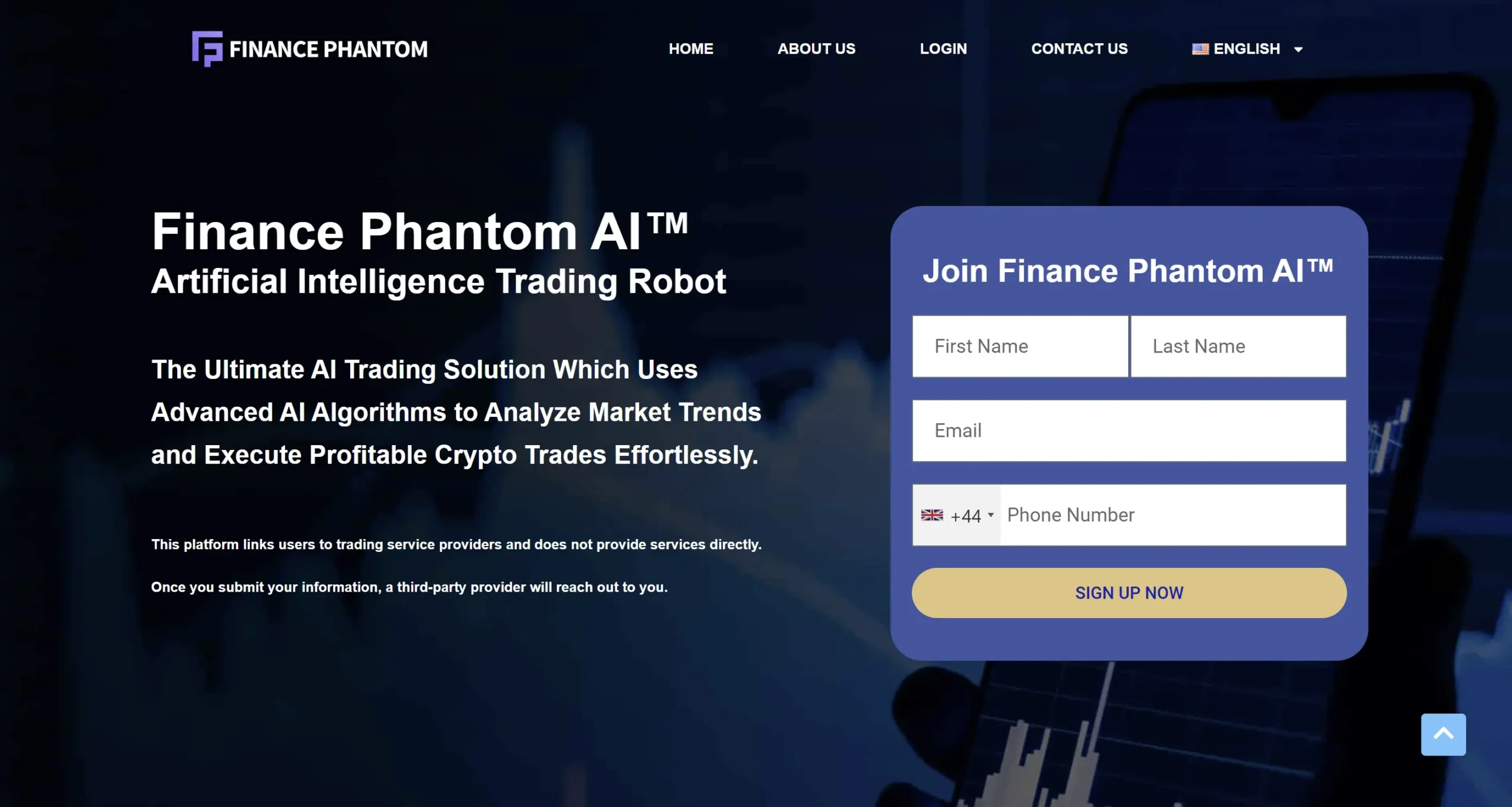

Technology significantly impacts modern investing. Firstly, various apps provide instant access to market data. As a result, investors can make informed decisions quickly. Moreover, algorithms analyze trends and offer valuable insights for better choices.

Additionally, online platforms simplify trading, allowing easy execution of transactions. Social media also fosters discussions about strategies and trends. Consequently, investors stay connected and informed. Furthermore, robo-advisors automate portfolio management based on individual risk tolerance. Ultimately, leveraging technology empowers investors to navigate the market efficiently and effectively.

Staying Informed: Continuous Learning

Staying informed is crucial in investing. First, the financial landscape constantly evolves, so continuous learning is essential. Moreover, various resources, like articles and podcasts, provide valuable insights. Consequently, investors can adapt to changing market conditions.

Additionally, attending webinars and workshops enhances knowledge about new trends. Furthermore, networking with experienced investors opens doors to shared experiences. As a result, one gains practical insights into effective strategies.

Reading books on investing broadens perspectives and deepens understanding. Ultimately, embracing lifelong learning empowers investors to make informed decisions and remain competitive.

Also Read: Smart Investment Strategies

Conclusion

In conclusion, investing demands careful planning and informed strategies. Understanding the basics forms a solid foundation. Additionally, effective research and diversification safeguard against risks. Recognizing long-term versus short-term approaches shapes investment goals. Furthermore, leveraging technology enhances decision-making. Continuous learning keeps investors updated. Ultimately, applying these strategies fosters financial stability and growth, leading to successful investment outcomes.